Home » Who really saves you more: a mortgage broker or a bank in Sydney?

It costs a lot of money, is stressful, and is hard to buy property in the Harbour City. As of early 2025, the median home value in Sydney was about $1.19 million. This means that every little bit of a percentage point on your interest rate counts.

But a lot of people who want to buy a home still go straight to the bank branch they’ve been going to since they were kids. It seems safe. It seems like something I’ve done before. But in the debate between mortgage brokers and banks in Sydney, loyalty often costs a lot of money.

Are you missing out on money by going straight? Or does a broker really have the secret to better savings? Let’s look at the facts and figures about getting a loan in Australia’s most difficult housing market.

Most people think their bank will take care of them. Sadly, loyalty doesn’t often pay off in the world of lending. It actually costs you a lot.

When you go to a bank branch in Parramatta or talk to a lender in the CBD, they have a set list of things they can sell you. They can’t tell you that the lender down the street is offering a rate that is 0.5% lower or that another lender has dropped their annual fees. It doesn’t matter if their loan fits your financial needs; their job is to sell it.

This is how you get stuck in the “One-Size-Fits-All” trap. The market in Sydney is complicated. A first-time home buyer buying a unit in the Inner West has very different needs than a self-employed investor buying a house in the Hills District. Banks often have trouble with this small difference, forcing square pegs into round holes and charging you for the privilege.

If you’ve been with the same bank for a long time, you might be experiencing “rate creep.” When banks offer new customers flashy, low introductory rates and then slowly raise the rates for their loyal customers, this happens.

If you don’t compare the market, you could miss out on:

Special rates just for brokers: Some lenders give brokers special rates that aren’t advertised to the public.

Exceptions to the rules: A good mortgage broker in Sydney knows which lenders will accept a short work history or a property title that is different from the norm.

Cashback offers: You shouldn’t pick a loan just because of these, but it’s hard to believe you missed out on $2,000 to $4,000 in cashback because your bank doesn’t offer it.

Choosing the wrong loan doesn’t just mean paying a little more each month; it adds up to thousands of dollars in lost wealth over the life of your loan.

Think about how different a “set and forget” bank customer is from an active borrower. If you get a standard variable rate from a big bank and don’t pay attention to it for five years, you could end up paying a lot more interest than someone who refinanced to a lower rate.

Recent information shows that the difference between the average rate for existing customers and the average rate for new customers is getting bigger. A 0.25% difference on a $800,000 mortgage, which isn’t uncommon in Sydney, adds up to about $2,000 a year. That could have been a vacation, new furniture, or a chunk of your principal paid off, but it all went to the bank’s profits.

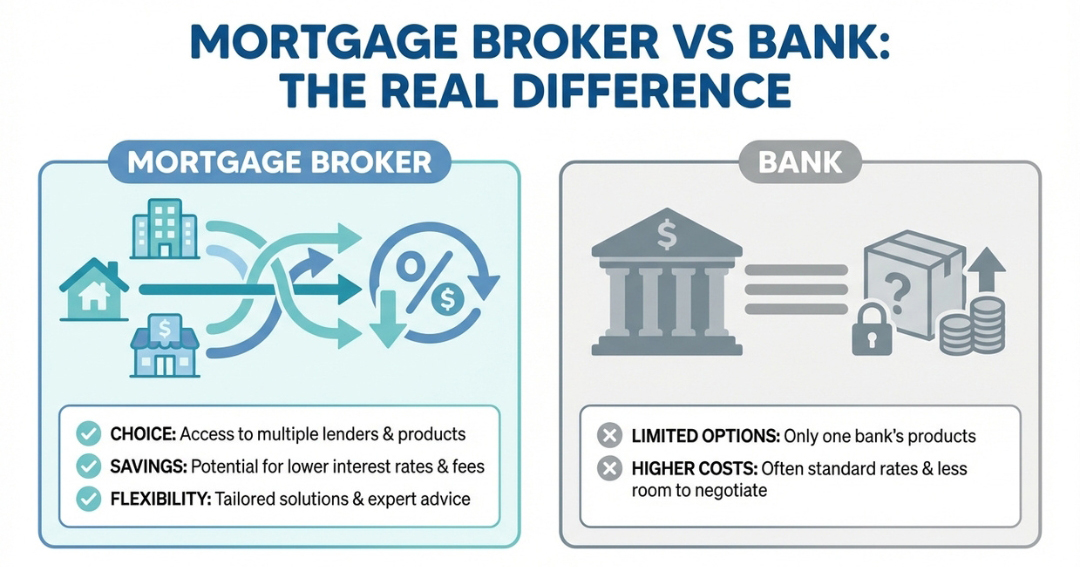

To understand the difference between a bank and a mortgage broker in Sydney, you need to know whose side they are on.

A bank officer is an employee of the bank. They are motivated to sell the products of their employer. They have one set of rules and one policy, and they can’t change them very much. They will turn you down if you don’t meet their specific requirements, such as your credit score, the size of your deposit, and the type of job you have. That’s all for now.

A broker is someone who works for you. Mortgage brokers in Australia are required by law to follow the Best Interests Duty (BID). ASIC is in charge of this law, which says that a broker must put your needs ahead of their own (or the banks’). This duty does not apply to bank employees.

When you hire a broker, they compare loans from a group of 20 to 30 lenders, including the Big Four, second-tier banks, and lenders that aren’t banks. They work out the best interest rates for you, set up the loan to fit your tax or lifestyle needs, and take care of all the paperwork from the application to the settlement.

The Mortgage & Finance Association of Australia (MFAA) says that mortgage brokers helped with a record 77.6% of all new residential home loans in the June 2025 quarter. Most Australians are voting with their feet.

Let’s get to the point. Who helps you save more money?

A lot of people don’t want to call a broker because they don’t want to pay for advice. But for most home loans, the borrower doesn’t have to pay for a mortgage broker Sydney service. The lender gives the broker a commission when the deal is done. The Best Interests Duty says that the broker can’t just recommend a loan to get a bigger commission; they have to show that the loan is right for you.

A broker can help you save money in three different ways:

Negotiating Interest Rates: Brokers can talk directly to credit assessors and BDMs (Business Development Managers). They can often ask for rate discounts that aren’t shown online.

Application Fees: New lenders may charge a fee to set up the loan, though many will waive this to win your business.

LMI Waivers: Some lenders will waive LMI for certain professionals, like doctors, lawyers, and accountants, even if they put down less than 20% of the purchase price. A broker knows exactly which lenders offer this, which could save you $10,000 to $30,000 up front.

Think of “Sarah,” a marketing manager who takes out a $800,000 loan to buy an apartment in Surry Hills.

The Bank Route: She goes to the bank she uses now. They give her their normal variable rate of 6.24%. She agrees because it’s simple.

The Broker Route: She goes to a broker who looks at 25 lenders and compares them. The broker finds a lender that will give them 5.89% interest and $2,000 back.

In just the first two years, Sarah could save almost $8,000 in interest and get cash back. That is what choice can do.

Even though the numbers are in favor of brokers, there are times when going direct is the best choice.

If you need to, go to a bank.

You have a very simple financial situation (full-time PAYG job and a large deposit).

You have a great, long-term relationship with a private banker who treats you better than other clients.

You like having all of your accounts (savings, credit cards, loans) under one login for convenience, even if it costs a little more.

If you want to use a mortgage broker,

You want the best mortgage broker in Sydney to help you find the lowest rate.

You are self-employed, a contractor, or have a complicated way of making money.

You are an investor who wants to get the most out of tax deductions and borrowing power.

You want a professional to handle the application process and fight for your approval.

Sydney is a one-of-a-kind place. Depending on the postcode, lending rules may change. For instance, some lenders have strict rules about high-density apartments in some suburbs, which means that you need to put down more money. Some people might be more lenient with inner-city terraces that don’t have a lot of land.

A local broker knows about these strange geographic things. They know which lenders like apartments in Sydney and which ones like houses in Western Sydney. This local knowledge keeps your application from being turned down for a small reason, which saves you time and keeps your credit file safe.

Most people know what the answer is when it comes to the mortgage broker vs. bank Sydney debate. A broker is better than a bank unless you love paperwork and hate saving money. They give you options, legal protection under the Best Interests Duty, and the chance to make deals that you probably couldn’t make on your own.

You can’t be lazy in a market as expensive as Sydney. Don’t let your loyalty to a bank logo keep you from being free with your money.

Are you thinking about buying or refinancing in Sydney?

Stop making guesses and start saving. Get a free, no-obligation home loan assessment today and see the numbers for yourself.

a2z finance australia home loan Home Loan Rates in Australia mortgage broker sydney refinancing home loan sydney home loans

Avoiding Fees: Brokers know which lenders charge application fees, valuation fees, or monthly service fees, and they can help you find lenders with lower fees.

Need help? Our team is just a message away